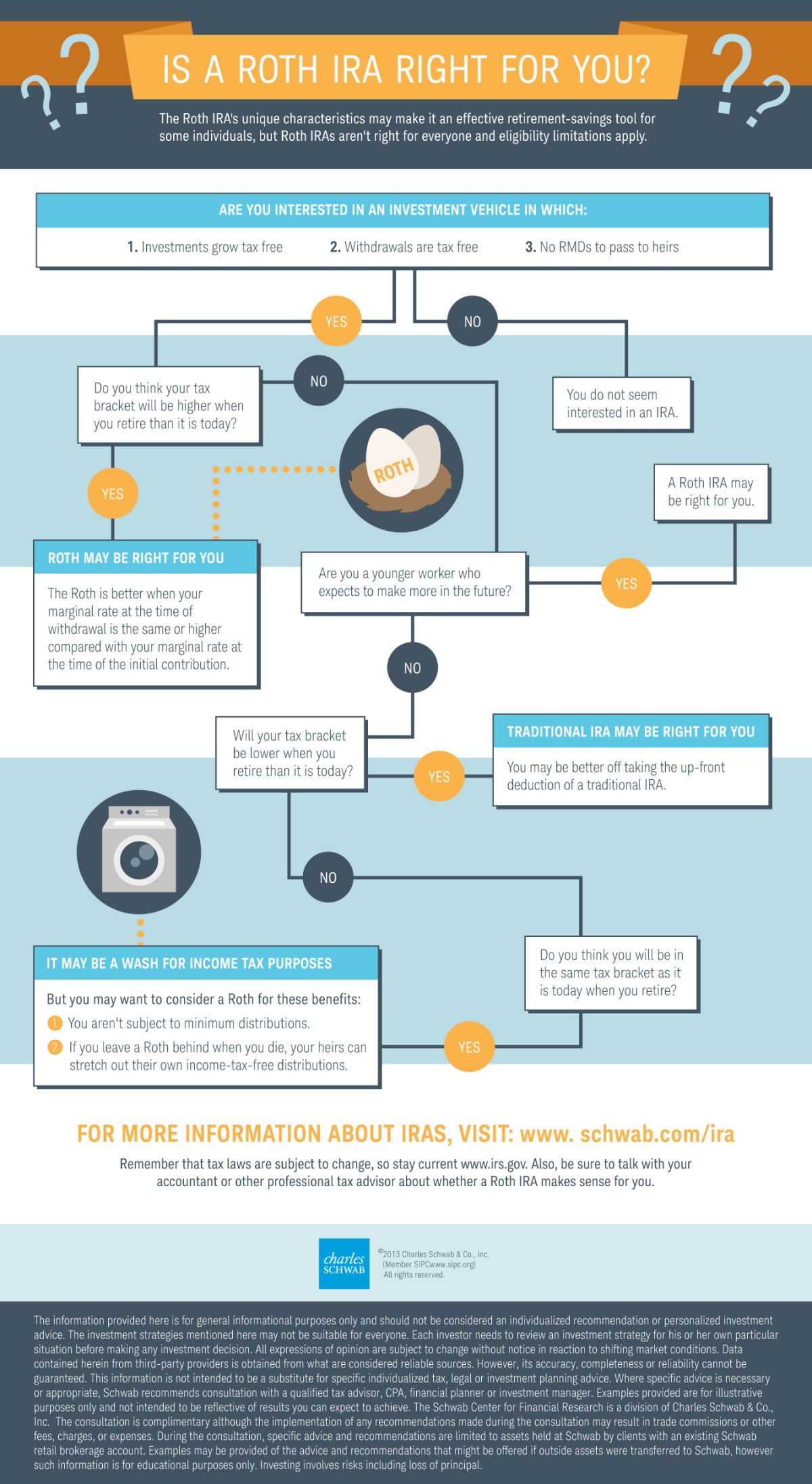

Is a Roth IRA Right For You?

If you are deciding between a Traditional or Roth IRA, check out this infographic. Both types of IRAs have their advantages and disadvantages. Regardless of which one you choose, it is more important to start contributing to an individual retirement account if you haven’t already. With company pensions becoming increasingly rare and potential social security issues on the horizon, it is important to save for retirement. If you haven’t started saving, start today! The best time to invest may have been in the past, but the second best time to invest is today!

Take advantage of one if your employer offers a plan such as a 401(k), especially if they offer a matching program. If they do and you are not contributing, it is literally throwing free money away. Since the money grows tax-free, in the future that amount will considerably larger than today. In addition to one at work, based on your situation, looking into contributing to a traditional or Roth IRA. See below for more details!

For more information on 2013 and 2014 contribution limits, click here.

For more on the benefits of IRAs, click here.